Understanding the Differences: W2 vs W9 vs W4 Form, and More

When it comes to tax forms in the United States, you might find yourself confused about the purposes and differences between forms such as the W9 vs W4 form, W4 vs W2, W2 vs W9 printable version, and others. Each of these forms plays a critical role in the tax filing process, serving distinct purposes for different types of income and employment situations. It is essential for you to understand when and how to use these forms correctly to ensure compliance with IRS regulations and to avoid any potential issues with your income tax filings.

Table of Contents

What is the Purpose of the W2, W4 vs W9 Form? [W2, W9 vs W 4 form]

What is the W-4 Form Used For?

The W-4 form is primarily used by employees like you to inform your employer about the amount of tax to deduct from your paycheck. This form contains your personal details, such as your social security number and filing status, which helps determine the correct withholding amount. The goal of the W-4 form is to ensure that the correct income tax is withheld from each paycheck, balancing your tax liability come tax season. You need to fill out a new W4 whenever your financial or personal situation changes significantly, such as when getting married or having a child.

Why Do You Need to Fill Out a W-9?

The W-9 form is generally used if you work as an independent contractor or freelancer. It is a request for taxpayer identification number and certification, which you fill out to provide your taxpayer ID to the person or business that will be paying you. Unlike the W-4, the W-9 form does not determine withholding; instead, it is used to prepare 1099 forms at the end of the tax year. The W-9 is also used to provide information needed for various reporting and compliance purposes, such as verifying your eligibility to work in the United States.

What is the W-2 Form Used For?

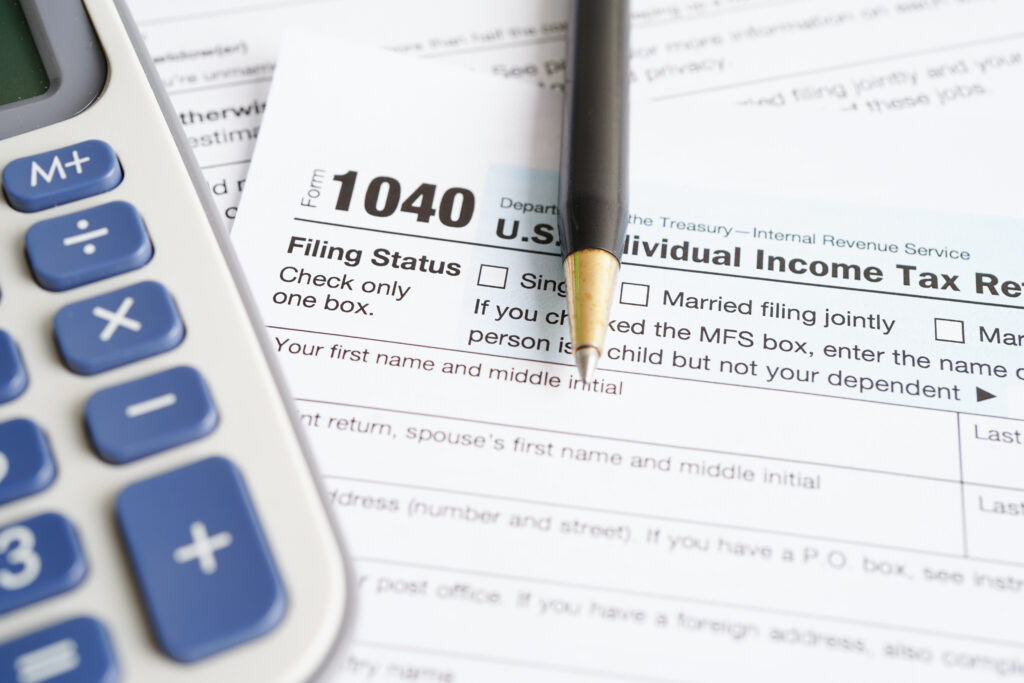

The W2 form is a federal document employers use to report wages paid to you as an employee and the income tax deducted from your pay during the year. It is a key document when filing your federal income tax return, as it provides a detailed summary of your total earnings and any taxes that have been deducted from your paycheck. By law, employers must provide this form to you by January 31 each year. Without this form, completing your form 1040 would be difficult since it contains vital information for calculating your income tax withheld at both the federal and state levels.

How Do W2 and W-9 Forms Differ? [W2 vs W9]

Understanding the differences between the W 9 printable version and the W2 form is essential for both employees and independent contractors. While the form W-2 is used to report wages and federal income tax withheld for employees, the w 9 tax form is primarily used by independent contractors and freelancers to provide their taxpayer ID to the companies that hire them. These companies will then use the information to prepare and submit a form 1099 to the Internal Revenue Service (IRS) at the end of the year, documenting the payments made to the contractor.

The major difference is that an employee uses on the W2 form to report wages and taxes withheld, while a contractor must submit a W-9 to ensure accurate form 1099-misc reporting.

Who Should Use W-4, W-2, W-9 Forms? (W9 vs W4 Form | W-4 vs W-2)

When to Use Form W-2

The W2 form is a federal form used by employers to report wages paid to you as an employee and the amount of taxes deducted. If you receive a salary or hourly wage and have income taxes withheld from your paychecks, you will receive a W2 form at the end of the tax year. This form is crucial for filing your income tax return, as it summarizes your total earnings and the amount of federal income tax withheld. Employers are required to provide the completed form W2 to you by January 31 each year, giving you ample time to prepare for tax filing.

- Understanding the Role of Independent Contractors

If you are an independent contractor, you are responsible for managing your own taxes. You will not receive a W2 form because your clients do not withhold taxes. Instead, you will need to fill out a form W-9 when you are hired, which provides your w-9 information to your clients. At the end of the tax year, you will receive a form 1099, which reports the total amount paid to you. You must then fill out form 1040 to report this income and pay any applicable taxes, including self-employment tax.

Real-Life Example: W2 vs W9, W-4 vs W-2, W9 vs W 4 Form

- W-2 Example: You work full-time at a company, and income tax is withheld from your paycheck. You receive a W2 form at year-end to file your taxes.

- W-4 Example: You start a new job or get married and need to adjust your income tax withholding by submitting a new form W-4.

- W-9 Example: You are a freelance graphic designer hired by a business; you fill out a W-9 form so they can report payments to the IRS using form 1099.

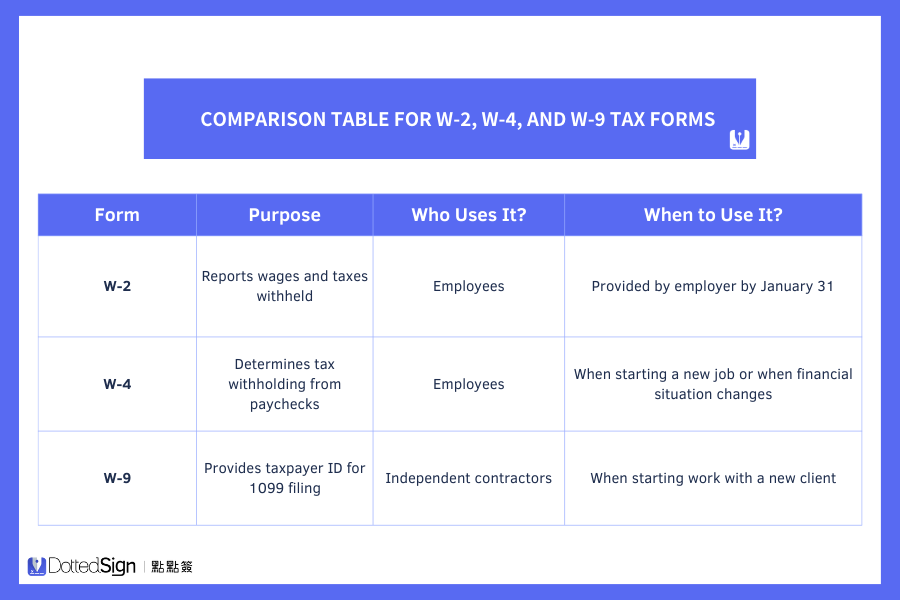

Comparison Table for W-2, W-4, and W-9 Forms (W9 vs W4 | W2 vs W9)

To help you understand the differences, here’s a detailed comparison:

IRS Guidelines for Filling Out Tax Forms

The IRS provides detailed guidelines for filling out IRS forms, including the current version of W-9 form, form W-4, and form W-2. These guidelines are designed to help you understand the requirements and ensure that all different forms are completed correctly. For example:

- Form W-4 Instructions: Include specific steps for determining income tax withholding allowances.

- Form W-9 Instructions: Clarify how to provide the correct taxpayer identification number.

- Form W-2 Instructions: Outline how employers should report wages and withheld taxes.

You are encouraged to review these guidelines thoroughly and seek assistance if needed, as errors can lead to delays or penalties during tax filing. Understanding IRS guidelines helps you fill out your federal forms correctly, reducing the risk of errors and penalties.

Impact of Employment Status Changes on Your Tax Forms

If your employment status changes—from employee to independent contractor or vice versa—you need to update your federal forms accordingly. For instance, transitioning from a salaried position to freelancing requires you to complete a W-9 for your new clients and adjust your estimated tax payments.

How to Fill Out Form W-9 and W-4 Correctly (W9 vs W4 Form)

7 Steps to Complete a Form W-9

Completing a Form W-9 is a straightforward process, but accuracy is crucial to avoid any issues. It is important to use a current version of the W-9 form, as an updated W-9 may include changes that need to be accounted for. Utilizing a W9 generator can help ensure all information is entered correctly and efficiently.

Here are the 7 key steps to complete your W-9:

- Provide Your Personal Details: Enter your name as shown on your tax return.

- Business Entity Information: If applicable, include your business name or disregarded entity name.

- Federal Tax Classification: Select the appropriate tax classification for your business type (e.g., individual/sole proprietor, C corporation, S corporation, partnership).

- Exemptions: Only fill this out if you are exempt from backup withholding.

- Address: Provide your mailing address as requested on the form.

- Taxpayer Identification Number: Enter your Social Security Number (SSN) or Employer Identification Number (EIN).

- Certification: Sign and date the form to certify that all information provided is accurate and complete.

Make sure to double-check the information before submitting, as incorrect entries may result in penalties or backup withholding.

7 Steps to Fill Out Form W-4

Filling out a form W-4 requires careful consideration of your financial situation, as it directly impacts how much federal income tax is deducted from your paycheck. The form also includes worksheets to help you determine the correct number of allowances or adjustments to claim, which affects the income tax withheld.

It is important to review your form W-4 annually or whenever your personal or financial situation changes, such as marriage or a new job, to ensure the correct amount of tax is deducted. Incorrect information on the W4 can result in under-deduction, where you will owe money at tax time, or over-deduction, where too much is taken out of each paycheck.

Here are the 7 key steps to complete your W4:

- Personal Details: Enter your name, address, filing status, and Social Security Number (SSN).

- Multiple Jobs or Spouse Works: Complete this section if you or your spouse has more than one job.

- Claim Dependents: Calculate and claim any dependents, including the child tax credit and credit for other dependents.

- Other Income (Optional): Include other income not from jobs, such as interest or dividends.

- Deductions (Optional): Account for deductions other than the standard deduction.

- Extra Withholding (Optional): Specify any additional tax you want deducted each pay period.

- Sign and Date: Validate your W4 by signing and dating it.

Using the worksheets provided on the current version of form W-4 is essential for determining the right number of allowances and ensuring your income tax withholding reflects your true tax liability.

5 Steps to Review Your W-2 Form

While employers are responsible for generating the W-2 form, you should know how to review it for accuracy:

Here are the 5 key steps to review your W-2:

- Check Personal Information: Ensure your name, address, and Social Security Number are correct.

- Verify Earnings: Cross-reference the wages reported with your final pay stub.

- Confirm Tax Withheld: Ensure federal and state taxes withheld match your records.

- Review Employer Information: Verify the employer’s EIN and address.

- Report Errors Promptly: If you find discrepancies, contact your employer immediately for corrections.

Common Mistakes When Filling Out Tax Forms

When filling out tax forms like the W-9 and W-4, common mistakes can result in incorrect withholding amounts or issues with IRS compliance. Errors such as providing an incorrect Taxpayer Identification Number (TIN) or failing to update your information when personal circumstances change can lead to problems.

Additionally, many people overlook the importance of using the most updated version of tax forms, such as the revised W-9 or the latest W-4, which may include important changes or clarifications. To avoid these pitfalls, it is essential to carefully read the instructions for each form and verify that all information is accurate before submission.

Here we will cover some of the most common mistakes and how to avoid them.

1. Incorrect TIN or SSN on W-9

One of the most common errors on the W-9 form is providing an incorrect Taxpayer Identification Number (TIN) or Social Security Number (SSN). Incorrect information can lead to backup withholding or even IRS penalties. Always double-check your TIN or SSN before submitting the form to ensure it’s accurate.

2. Overlooking Additional Income on W4

When filling out the form W-4 form, many individuals fail to account for additional income sources, such as interest, dividends, or freelance work. This can result in under-withholding, leaving you with a large tax bill at the end of the year. To prevent this, make sure you include all sources of income when completing your W4.

3. Common Mistakes on W-2 Forms

- Mismatched Information: Errors in your personal details or employer information.

- Incorrect Wage Reporting: Mistakes in reported wages or taxes withheld.

- Missing the Filing Deadline: Not using your W-2 to file taxes by the April 15 deadline can result in penalties.

4. Not Using the Latest Version of Forms

Using outdated tax forms, like an old version of the W-9 or W-4, can lead to errors or omissions due to changes in tax regulations. Ensure you always use the most current form versions, which reflect the latest IRS guidelines and adjustments.

DottedSign Prevents Common Mistakes

By using DottedSign to fill out your tax forms, you can minimize these mistakes. DottedSign provides a step-by-step guide through the signing process, ensuring all required fields are completed correctly and helping you avoid common errors or omissions.

Start your trial today with DottedSign and avoid common tax form mistakes.

Consequences of Not Submitting Tax Forms on Time

Penalties for Late Submission of W-9

If you fail to provide a completed W-9 to a requester, you may be subject to backup withholding at a rate of 24% on your payments. Additionally, the IRS may impose penalties for intentional disregard.

Implications of Incorrect W-4 Filing

Submitting an inaccurate W4 can result in incorrect tax withholding. If too little tax is withheld, you may owe a large sum when filing your tax return, possibly with interest and penalties.

Consequences of Errors on W-2 Forms

Errors on your W-2 form can lead to:

- Delayed Tax Refunds: Incorrect information may slow down the processing of your return.

- IRS Notices: Significant discrepancies can trigger IRS notices or audits.

- Penalties: Failure to report all income can result in fines or additional taxes owed.

How to Electronically Sign a W-2, W-4, or W-9 Printable Version?

In today’s fast-paced world, you do not want to be stuck signing forms manually. Fortunately, DottedSign offers you an easy way to electronically sign your W-2, W-4, or W-9 forms without the hassle of printing, scanning, or mailing.

Legal Validity of Electronic Signatures

Electronic signatures are legally binding under the Electronic Signatures in Global and National Commerce (E-SIGN) Act. Using DottedSign ensures your electronic signature is compliant with federal laws, giving you peace of mind when signing tax documents like the W-2, W-4, or W-9 forms.

How you can electronically sign your W2, W4, or W9 printable version using DottedSign

- Upload Your Form: Simply upload your W2, W4, or W9 printable version onto the DottedSign platform.

- Fill Out Your Information: Use our intuitive tools to enter all your required details, including your taxpayer identification number (TIN) for W-9s, and personal information for W-2 or W-4 forms.

- Add Your Signature: You can either type, draw, or upload your signature to the form.

- Review and Confirm: Double-check all the information for accuracy.

- Send It Securely: Once your form is complete, send it to your employer or client directly from the platform.

Why Choose DottedSign for Your Digital Signatures?

- User-Friendly Interface: DottedSign is designed with you in mind, making the signing process straightforward.

- Secure and Compliant: We use advanced encryption to protect your data and comply with all legal requirements.

- Time-Saving: Sign documents anytime, anywhere, without the need for physical paperwork.

- Audit Trail: Keep track of all your documents with a comprehensive audit trail for legal compliance.

Get Started with DottedSign Today

Whether you are signing W2, W4, W9 forms, or other important tax forms, DottedSign helps streamline your workflow and ensures secure and compliant form submission. Try DottedSign today and experience the convenience of digital signatures.

W-9 Forms and Self-Employment Tax

If you are an independent contractor or freelancer using a W-9, paying self-employment tax is one of your biggest responsibilities.

1. Self-Employment Tax: What You Need to Know

Self-employment tax covers Social Security and Medicare taxes for individuals who work for themselves. As an independent contractor, you must pay these taxes yourself, which amounts to a total of 15.3% of your income—12.4% for Social Security and 2.9% for Medicare.

- 12.4% for Social Security

- 2.9% for Medicare

Source: IRS Self-Employment Tax

2. Quarterly Estimated Tax Payments

As a contractor, you are not only responsible for self-employment tax but also for making quarterly estimated tax payments to the IRS. These payments are based on your expected income for the year and are necessary to avoid penalties. If you underpay or fail to make these payments, you may face additional charges at the end of the year.

DottedSign Helps You Stay Organized

Using DottedSign to manage and submit your W-9 forms ensures that you have a digital record of all your tax forms. This makes it easier to stay on top of your estimated tax payments and keep track of self-employment tax obligations.

Start Your Free Trial Today to Keep Your Tax Documents Organized and Avoid Missing Important Payments

IRS Audits and W-9 Compliance

Failing to submit accurate W-9 forms can result in IRS penalties or even trigger an audit, which is why it is important to maintain accurate records.

How Missing or Incorrect W-9 Forms Trigger Audits

If you fail to provide accurate information on a W-9 form, such as your taxpayer identification number (TIN), your client or employer may be required to withhold 24% of your payments as backup withholding. Additionally, discrepancies between the information you report and the IRS’s records could trigger an audit.

Backup Withholding and Its Implications

Backup withholding is a safety measure implemented by the IRS to ensure taxes are collected in case of discrepancies. If backup withholding is applied:

- Reduced Payments: You willl receive less money upfront.

- Resolution Time: It can take time to resolve the issue and recover withheld funds.

- Financial Strain: Penalties or fines may add more financial strain.

Protecting Your Personal Information When Submitting Tax Forms

In the digital age, safeguarding your personal information is more important than ever.

Tips for Securely Submitting Tax Forms

- Use Trusted Platforms: Only submit your forms through secure, reputable platforms like DottedSign.

- Encrypt Sensitive Data: Ensure that any digital documents containing personal information are encrypted.

- Be Wary of Scams: Beware of phishing emails or fake websites requesting your personal information.

DottedSign Prioritizes Your Security

We use advanced encryption technologies to protect your data. Our platform is designed to ensure that your personal information remains confidential throughout the signing process.

History and Evolution of Tax Forms W-2, W-4, and W-9

Understanding the background of these forms can give you deeper insight into their importance.

Origins of the W-2, W-4, and W-9 Forms

- W-2 Form: Introduced to standardize the reporting of employee wages and tax withholdings.

- W-4 Form: Created to allow employees to control how much tax is withheld from their paychecks.

- W-9 Form: Developed to collect taxpayer information for independent contractors and reduce tax evasion.

Changes Over the Years

Tax laws and regulations change frequently, leading to updates in these forms. Staying informed about these changes ensures that you are compliant with current tax laws.

What Are the Key Changes in the Updated W-9 and W-4 Forms?

Overview of the New W9 and Its Features

The new W-9 form includes several updates that you need to be aware of:

- Reporting Foreign Accounts: Inclusion of additional fields for reporting foreign financial accounts, reflecting the increased emphasis on global tax compliance.

- Clearer Instructions: Provides clearer guidelines for individuals who are subject to backup withholding, ensuring that you understand how to report your taxpayer identification number correctly.

- Digital Accessibility: The form is now more accessible for electronic completion and submission.

These changes are designed to streamline the process and improve accuracy in reporting.

Changes in the Current Version of W-4 Form

The current version of the W-4 form includes changes aimed at simplifying the withholding process:

- Elimination of Allowances: The form no longer uses allowances, which were previously based on personal exemptions, due to changes in tax law.

- Simplified Steps: Focuses on straightforward questions to help you determine the correct withholding amount.

- Enhanced Worksheets: Provides additional worksheets to account for multiple jobs or other income sources.

This change is intended to make the form easier for you to complete and understand, reducing the likelihood of errors and miscalculations in tax withholding.

Impact of Tax Year Updates on Tax Forms

Each tax year may bring updates to tax forms, reflecting changes in tax law and IRS regulations. These updates can significantly impact how you fill out forms like the W-9 and W-4, as well as the information required. For example, changes in tax rates or the introduction of new credits can affect your withholding calculations and the information you need to provide on tax forms.

- Tax Rate Changes: Adjustments in tax rates can affect withholding calculations.

- New Credits or Deductions: Introduction of new credits can alter the amount of tax owed or refunded.

- Form Revisions: Updates to forms may include new fields or eliminate outdated ones.

By staying informed about these updates, you can avoid filing errors or penalties that may arise from outdated information. Make sure to regularly check IRS updates to stay on top of any changes that could affect how you complete your tax forms.

It is crucial that you always use the most current versions of these forms to ensure compliance and accuracy in your tax filings.

Where to Find W2, W4 and W9 Printable Versions?

- Accessing the W-9 Printable Version

You can easily access a W-9 printable version online through the IRS website or other reliable tax resources. Having a printed form can be useful if you prefer to fill out forms by hand or need a physical copy for your records. It is important to ensure that the version you use is the most recent, as older versions may not include current updates or requirements.

- Using a W9 Generator for Efficiency

A W9 generator can be an efficient tool for completing the form online, especially if you need to fill out multiple forms quickly. These generators guide you through each section of the form, ensuring that all necessary fields are completed accurately. They also provide an electronic version of the completed W-9, which you can easily share with clients or store for future reference.

- Finding Reliable Sources for Tax Forms Online

Reliable sources for online tax forms include the official IRS website and trusted tax preparation services. These platforms offer the latest versions of all necessary tax forms, including the W-9, W-4, and W-2, as well as guides and instructions for completing them. You should be cautious when downloading forms from unofficial sites, as these may be outdated or incorrect, potentially leading to errors in tax filing.

Reliable sources for online tax forms include:

- IRS Official Website: Offers the latest versions of all necessary tax forms.

- Trusted Tax Software: Platforms like TurboTax or H&R Block provide access to updated forms.

- DottedSign Platform: Allows you to access, fill out, and sign all necessary tax forms in one place.

DottedSign Provides Easy Access to Tax Forms

With DottedSign, you can:

- Save Forms for Easy Access: Store forms as reusable templates for quick access & future use.

- Fill Out Forms Efficiently: Use intuitive tools to complete forms accurately.

- Sign and Submit Electronically: Streamline your tax preparation process.

Start Your Trial and Experience Hassle-Free Form Signing and Management

Frequently Asked Questions (FAQs)

- Can I Use DottedSign to Sign Other Tax Forms Like W-4 and W-2?

Yes, DottedSign allows you to electronically sign various tax forms, including W-4 and W-2, making your tax preparation process more efficient.

- What If I Made a Mistake on My Tax Form?

If you realize you have made a mistake, you should fill out a new form and submit it as soon as possible. DottedSign makes it easy to correct and resend documents quickly.

- How Secure Is My Information with DottedSign?

We prioritize your security by using advanced encryption and secure servers to protect your personal information.

Conclusion

Tax forms like the W-4, W-9, and W-2 serve different purposes depending on your employment situation. Ensuring that they are completed accurately is crucial for IRS compliance. By using DottedSign, you can simplify the process of filling out and submitting these forms, ensuring that your information is handled securely and efficiently.

Start your trial today with DottedSign to experience hassle-free form signing and management.